The Bottom Line

💰 My dividend income increased from $278/month ➡️ $282/month, my owned income is $550/month

📊 Download my FREE Budgeting & FIRE Spreadsheet

📈 Read my latest coverage on Bitcoin ETF BTCI

Personal Finance

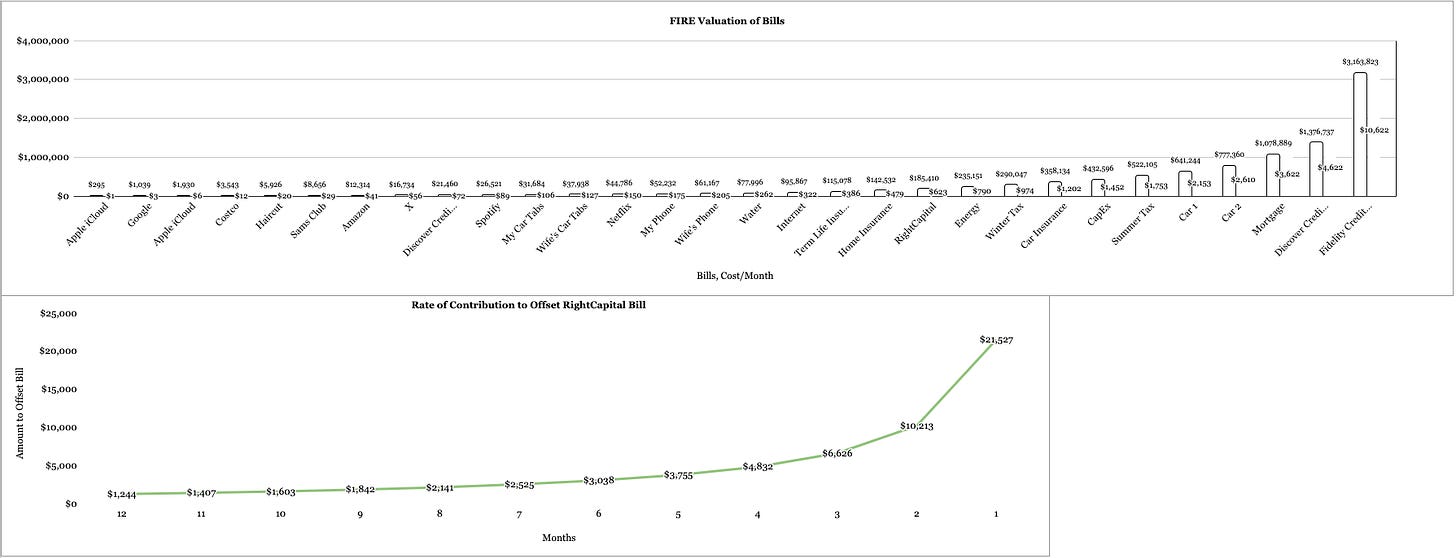

I’m deleveraging my emergency fund by investing in stocks, real estate, and businesses to own my income. Join me in using my free template to offset one bill at a time and achieve financial security. Every $1 of monthly income I own is $6 I do not need in my emergency fund. The goal is to eliminate my emergency fund to become financially secure.

I got laid off this month. This is why I preach to all my followers and clients to strive toward owning your income to create financial security for your family. This couldn’t be more ironic for my brand and business. I’m probably in the top 1% of Americans mentally and financially prepared for a layoff. Due to this life update and the release of my template, I’m switching the reporting from just Dividend Income to also include my Owned Income, which is $550/month.

Owned Income is primarily income from stocks, real estate, and businesses you own. It also includes interest income and active income from side hustles or from within your business. I choose to leave out my active income from this $550/month as that’s not stable. Instead, I focus on income I both own and can forecast. If you’re a $5/month paid sub you can see exactly what dividend paying stocks & ETFs I invest all my active income in to achieve this.

Now, can we live on $550/month? No. Can we live on $3000/month? Yes. That means I need to make $2500/month in active income to survive in the short-term. What would you do if you lost your job TODAY? Comment below!

In January, I was working toward offsetting my Internet bill with just my dividends. When I factor in the rest of my owned income, we actually see that my internet, term life insurance, and home insurance bills are covered. So, the next bill is a software subscription I have for my business. Remember, your FIRE number is a moving target based on portfolio yield, estimated income, and cost of your bills. It’s best to focus on increasing your monthly income $1 at a time because this number will change every month.

Investing

📈 Read my latest publication on Bitcoin BTCI: A Smarter Way To Hold Bitcoin For Income And Growth for FREE on Seeking Alpha.

Free Template and Financial Health Screening

📊 Download my FREE Google Sheets template to create a budget and calculate exactly what your bills actually cost you and how much you need to become financially independent. This is a reality everyone will need to face at some point in their lives. You will not find a spreadsheet capable of forecasting your budget, cash flow, and cash supply this precisely.

If you want a second opinion on your budget, debt management, and financial plan reach out for a free consultation and financial health screening using one of my links. Year to date I’ve helped several clients create budgets, come up with debt payoff strategies, and simplify accounts to manage their money automatically.